Floral industry members across segments have a relatively optimistic take on the economic landscape, according to a new survey from the Society of American Florists.

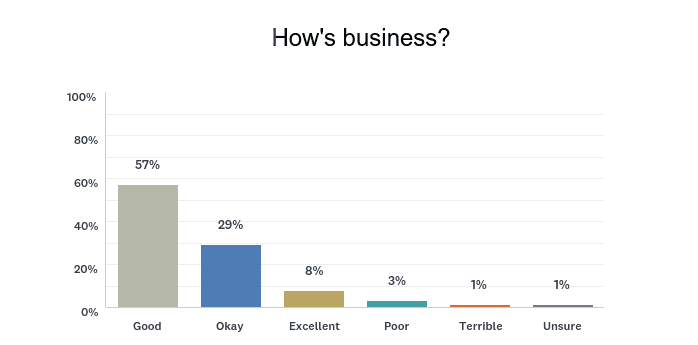

In response to the question “How’s business?”, 57 percent of respondents answered “good” while only 3 percent described it as “poor.” About 29 percent classified business as “OK.” Eight percent called it “excellent” and less than 2 percent termed it “terrible.” (Remaining respondents said they are “unsure.”)

When SAF surveyed members at the same time last year, 49 percent classified business as “good”; 38 percent as “OK”; 9 percent said “excellent”; 3 percent said “poor” and 1 percent, “terrible.”

The Economic Outlook Survey was emailed to SAF members on January 21, 2019 and had a response rate of 7.9 percent.

Overall, 51 percent of all respondents this year said they are “optimistic” about sales in 2019, with another 11 percent calling themselves “very optimistic.” Twenty-nine percent said they are “neutral/uncertain”; only about 8 percent said they were either “pessimistic” or “very pessimistic.”

These answers were consistent across segments — although respondents who identified as wholesalers, suppliers or importers appear to have the sunniest outlook, with 18 percent classifying themselves “very optimistic” about the new year.

These results did not surprise Charles R. Hall, Ph.D., professor and Ellison Chair in the Department of Horticultural Sciences at Texas A&M University and the 2018 winner of SAF’s Paul Ecke Jr. Award.

“To be in this industry, you almost have to be an optimist,” he said with a laugh, before noting that — while many challenges exist — a number of economic factors support the positive take. “It’s been a strong period for flower sales, and that’s correlated to the business cycle and consumer confidence, which is up.”

Key Issues Facing Businesses

Among all respondents this year, 63 percent said “the availability of labor” is having an effect on their business. That doesn’t surprise Hall either. “Since right before the last recession started, labor costs are almost exactly one-third higher,” he said, noting that, thanks to low unemployment levels, “as wages go up in other sectors, folks have a choice where to work.”

That was a sentiment shared by a retailer respondent in the West. “It seems like the quality workforce is already employed,” he said. “Overall, we are a relatively low-paying industry, and it seems like the younger crowd will leave if a better paying job becomes available.”

About 56 percent of respondents to this year’s survey say they expect to spend more on labor this year — even though 47 percent do not plan to hire additional permanent staff in the next six months and only 38 percent are planning increases in salaries or pay in the same time period. Meanwhile, 43 percent of respondent agreed with the statement “We have a difficult time attracting non-seasonal candidates for entry-level positions”; and 52 percent agreed with the statement “We have a difficult time attracting non-seasonal candidates for experienced design positions.”

“It’s really hard to find people for this industry cold,” wrote one wholesaler in the Pacific Northwest. “Not that we haven’t had luck, but I find existing employees who bring people in has worked the best. The job, the hours — they’re are not sugar-coated. People say they love the morning, until the third day of waking up at 3 a.m. or 3:30 a.m.”

“Getting the millennial generation to stay longer than three months ,” wrote one retailer in the Midwest. “They are excited in the beginning and jump in, assign more responsibilities after the three-month benchmark, they don’t want to take on more. Often, the ones who do take it on are college students and end up leaving after a few years for a job in their career. The flip side is trying to retain the older generations in a sales position that pays minimum wage plus bonus.”

Another retailer from the Pacific Northwest summed up her labor challenges in three points: a lack of skilled designers, a time crunch to find and keep people and common misperceptions among the public about what it’s like to work in a busy flower shop.

“As the sole operator of a small shop, I am maxed out and training is a huge time commitment,” she explained. “I literally have to decide what won’t get done when I spend time training and the number of times it hasn’t worked out is demoralizing. People think it would be fun to play with flowers all day. They are not prepared for reality of shop life.”

Other key issues noted in the survey and expected to impact companies: “minimum wage” (55 percent); “trade and tariff issues” (43 percent); “health care costs” (40 percent); “transportation” (29 percent); “supply chain logistics” (24 percent); and “tax reform” (11 percent). Nearly 23 percent of respondents also said the “partial federal government shutdown”, which started Dec. 22, 2018 ended Jan. 25, 2019, affected their business.

The top three issues by segment from the survey are:

- Growers: availability of labor (77 percent); transportation (69 percent); health care costs (54 percent) and minimum wage (54 percent)

- Wholesalers, Suppliers, Importers: transportation (63 percent); health care costs (57 percent); availability of labor (53 percent)

- Retailers: availability of labor (64 percent); minimum wage (60 percent); and trade/tariff issues (42 percent)

Hall said all of these concerns are valid, and he pointed to those associated with higher input costs (including minimum wage and transportation) as especially challenging.

“As input costs increase, margins shrink,” he said, adding that the primary way to offset those increases is to adjust your own prices. “If your prices stay the same, you’re just eating your margins.”

Sales Trend Breakdown

About 54 percent of all respondents said their 2018 gross sales were higher than those in 2017; 27 percent said they were about the same and 18 percent said they were down. (A small percentage, less than 2 percent, wasn’t sure how gross sales compared, year over year.)

About 54 percent of all respondents said their 2018 gross sales were higher than those in 2017; 27 percent said they were about the same and 18 percent said they were down. (A small percentage, less than 2 percent, wasn’t sure how gross sales compared, year over year.)

By comparison, last year, about 51 percent of all respondents said 2017 gross sales were up over 2016, 24 percent said they were the same and 24 percent said they were down. (A similar sized group last year also was uncertain of year-over-year gross sales comparisons.)

Looking at this year’s responses for gross sales trends by segment (2018 compared to 2017):

- 46 percent of growers said sales were up; 31 percent said they about the same and 23 percent said they were down.

- 77 percent of wholesalers, suppliers, importers said sales were up; 18 percent said they were about the same; 3 percent said they were down; remaining respondents were unsure.

- 51 percent of retailers said sales were up; 28 percent said they were about the same; 20 percent said they were down; remaining respondents were unsure.

Among all respondents who saw gross sales drop in 2018, 74 percent said the decrease was between 1 and 10 percent. Among those who saw an increase, 73 percent charted the gains between 1 and 10 percent.

Spending Predictions in Other Areas

The survey also shed light on spending expectations for 2019 in other areas, beyond labor. Among those findings:

- Perishable product: 43 percent expect spending to be about the same; 40 percent said they predict it will be up

- Hard Goods: 46 percent about the same; 32 percent up

- Giftware: 31 percent the same; 24 percent up; 22 percent down

- Energy: 55 percent the same; 26 percent up; 9 percent uncertain; 5 percent down

Findings were more varied when it came to planned expenditures on capital investments: 39 percent plan to spend the same this year; 17 percent said their spending will be up; 15 percent said it will be down; 19 percent said they are uncertain. A small remaining percentage said the category is not applicable to them.

Respondents Share Perspective on Sustainability, Origin Questions

Forty-three percent of this year’s total respondents said they “occasionally” source sustainably grown/manufactured products — 42 percent said the same in the survey last year. About 24 percent of respondent this year said they source such products “regularly,” compared to roughly 30 percent last year.

Eighty-two percent of retailer respondents this year said they are rarely/never asked about sustainably grown/manufactured products, which tracks closely with last year’s responses (81 percent).

Meanwhile, 47 percent of retailers this year said they are “occasionally” asked where flowers come from; 39 percent said they are “never/rarely” asked. (In last year’s survey, 54 percent of retailer respondents said they are “occasionally” asked about flower origin; 36 percent said they were “rarely/never” asked.) These responses remained fairly consistent when filtered by shop size (in annual sales) and location.

Only about 15 percent of respondents this year said they are willing to pay up to 10 percent more for products that are sustainably grown or manufactured; 41 percent said “maybe.” (Less than 2 percent are willing to pay up to 20 percent more.) Last year, 22 percent of respondents said they would pay up to 10 percent more and 3 percent would pay up to 20 percent more.

Hall said he’ll be interested to see if these numbers change in the coming years, as younger generations become more influential consumers.

“Questions about sustainability are intriguing to me,” he said. “On the whole, there is a more sustainable mindset among younger people. I think we will see more of an interest in these products from millennial and Gen Z consumers. “

Many of the issues noted in the survey by respondents across segments — including labor concerns and information on taxes and tariffs — will be discussed next month during SAF’s annual Congressional Action Days in Washington, D.C. It’s not too late to sign on to attend and make your voice heard on March 11-12. Find out more and register today.

Mary Westbrook is the editor in chief of Floral Management magazine.