A Tuesday holiday was a boon for most florists — and for many Society of American Florists members, the gains this year were significant.

A Tuesday holiday was a boon for most florists — and for many Society of American Florists members, the gains this year were significant.

About 88 percent of respondents to an SAF post-holiday survey experienced an increase in Valentine’s Day sales this year, compared to 2016, when the holiday fell on a challenging date, the Sunday of a long weekend. About 7 percent of respondents said sales remained about the same this year; the rest saw a decrease. Those results were fairly consistent across business size, with respondents who have $1 million-plus in sales even more likely to report an increase (96 percent).

Among those who saw an increase, 34 percent said sales rose by more than 21 percent. What’s more, nearly half of all respondents said sales this year were higher than those in 2012, when Valentine’s Day last fell on a Tuesday.

“ was good in every way,” wrote one respondent cheerfully from Indiana, noting the business saw “increases in sales, cooperative teamwork … new customers.”

Another respondent, this time from New Jersey, said the business “sold everything,” thanks in part to great pre-holiday prep and organization, and the decision to focus customers’ attention on “less than 10 upscale Valentine’s Day designs.”

In New Hampshire a respondent saw “a lot of walk-ins who just wanted cash and carry mixed bunches, which we had pre-made at a very good price. It was a win-win. sold a ton of those.”

Ninety-five percent of respondents who saw an increase attributed the positive returns at least in part to the day of the week. Weather may also have played a factor: About 47 percent credited favorable conditions.

Still, good fortune was not universal — and neither was good weather. About a quarter of respondents who saw sales drop pinned the decline to weather-related issues

“We had 30 inches of snow in the Northeast on Feb. 13,” one respondent from Maine explained. “ shut down our state and people were still shoveling and cleaning out on Valentine’s Day. We had stuff left over. Mother Nature was not on our side.”

Source: SAF 2017 Valentine’s Day Survey. Emailed Feb. 20, 2017 to 2,839 retailers. 11.9 percent response rate.

In addition to sales-busting storms, many of those who saw a decrease blamed competition from mass marketers/supermarkets (29 percent); other florists (26 percent); order gatherers (23 percent); non-floral vendors (10 percent); and street vendors (6 percent). They also said their regional economy (19 percent) played a factor. Indeed, in several write-in responses, florists cited local and national economic issues.

“I think there was a drag on florists because of a lack of disposable income,” a florist in Kansas explained. “I think that lack of income made people either skip flowers this year or respond to the deceptive discount deals … People more and more are looking for deals on the holidays. It is hard for a florist who wants to be honest and fair to compete with those deceptive offers.”

Meanwhile, a florist in Arkansas wondered if a new administration in the White House, a strong stock market and the potential for lower taxes in the future hadn’t “bolstered the average Joe’s confidence.”

“Honestly, my core consumer is the middle class, upper-class and blue collar white man,” the respondent wrote. “He feels hopeful now. No one was tense or angry- even complaints or mess ups were easy. It was a completely different attitude.”

In Kentucky, another respondent said the shop felt confident enough moving into the holiday to nudge up prices.

“We raised our prices for product and deliveries and heard no complaints,” the respondent noted. “Clients saw the difference in the quality and variety of flowers and designs and they opened their wallets and kept our register ringing.”

Read more for granular info on holiday sales from the SAF member survey — along with feedback from some national companies on sales results.

Sales Breakdown: The Increases and Decreases

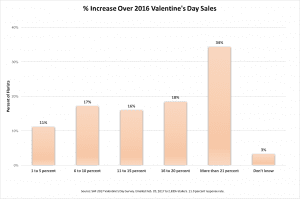

In addition to the 34 percent of respondents who said sales rose by more than 21 percent, about 18 percent said the increase was between 16 and 20 percent. Seventeen percent pinned their uptick at 6 to 10 percent; 16 percent said it was from 11 to 15 percent and 11 percent said it was from 1 to 5 percent.

Increases seemed to come in across ordering channels: 75 percent of respondents saw higher walk-in sales; 75 percent reported higher phone sales and 73 percent saw increased web sales. In addition, about 7 percent reported increased wire-out orders and 18 percent reported increased wire-ins.

Among those who saw decreased sales, about 33 percent weren’t sure of the decline amount. Twenty percent said their drop-off fell within the 6- to 10-percent range, and 17 percent said sales dropped by more than 21 percent. Thirteen percent said it was a smaller drop of 1 to 5 percent, 10 percent said it was between 16 and 20 percent and 7 percent said sales fell off by about 11 to 15 percent.

What Customers Bought — and How Much They Paid

Red roses remained a popular choice for consumers: 67 percent of rose orders were for red varieties. (And 51 percent of all orders were for roses.) Respondents also noted that about 40 percent of orders were for mixed flowers and 7 percent were for non-rose, single flower type arrangements (for instance, all tulips).

Respondents on average charged $85 for a dozen, arranged, long-stemmed roses for the holiday and about $66 for a dozen, unarranged long-stemmed roses. Both numbers are in line with 2016 results, when florists reported charging $83 for arranged versions and $65 for unarranged. The average overall transaction for Valentine’s Day this year was $78, slightly lower than last year’s $84.

About 54 percent of respondents said chocolate or candy were the most popular non-floral gift item; 17 percent said balloons were their non-floral item, followed by greeting cards (14 percent), plush (9 percent), gift baskets (3 percent) and candles (2 percent).

Florists reported that the holiday sales make up about 13 percent of their annual sales, a number roughly in keeping with last year’s estimate (12 percent).

Holiday Logistics

One complaint about the holiday — customers sure do drag their feet, don’t they?

“A great holiday, but people are waiting later and later to order or come in,” noted one florist in Colorado. “That is a problem in planning …The internet has people spoiled. instant gratification.”

This year, respondents said almost 58 percent of holiday orders came in before Valentine’s Day, while nearly 38 percent came in on Valentine’s Day. The mid-week holiday may have created heightened demand for day-of delivery: Almost 79 percent of holiday orders for delivery were delivered on Valentine’s Day, according to florist responses. (Last year, respondents reported that 78 percent of orders came in before Valentine’s Day, 13 percent came in on the holiday itself, and only about 18 percent of orders were delivered on Valentine’s Day.)

The Tuesday holiday may also have created a small “spillover” effect, with new holiday orders coming in even after Feb. 14 had come and gone. About 53 percent of respondents took up to 10 new Valentine’s Day orders the day after the holiday. Seventeen percent took between 11 and 20 new holiday orders on Feb. 15; 10 percent took 21 to 30.

One note to consider: While most florists were bullish on the Tuesday holiday, they also don’t see it as the strongest performer. In fact, 44 percent of respondents said Wednesday is the best day for Valentine’s Day — which is the day of the week for Valentine’s Day 2018.

Promotional Efforts Distilled

Compared to 2016, 55 percent of respondents said they kept their promotional efforts for Valentine’s Day on par with last year. Thirty-four percent said they increased them and about 6 percent reduced efforts.

Almost 80 percent of respondents used social media to promote Valentine’s day. Other popular forms of promotion:

- Store signage, posters and displays, 64 percent

- Online advertising, 55 percent

- Email promos, 54 percent

- Early order incentives, 34 percent

- Print advertising, 34 percent

- Outdoor advertising, 30 percent

- Early delivery incentives, 27 percent

- Radio ads, 26 percent

- Direct mail, 15 percent

- PR/media, 15 percent

- Partnerships with local businesses, 13 percent

- TV ads, 5 percent

Echoing the sentiment of several write-in responses, a florist in Texas said the shop increased its ad spending on Google this year; a shop in New York posted regularly to Facebook and created short videos for Instagram. Another Texas florist leveraged radio and local partnerships (a jeweler and steakhouse) for a themed contest that asked listeners for their best love stories. In Wisconsin, at least one florist took a proactive approach and called every single customer it could reach.

“We take the last two years of orders and direct mail an early order incentive and then we call all customers as a reminder and encourage them to place the order now and we will not charge the card until Valentine’s Day,” the respondent noted.

Costs, Flower Origin and Workforce Issues

The majority of respondents said prices on red roses, non-red roses, specialty flowers, non-specialty flowers and novelty containers were on par with last year. About 52 percent of respondents said prices were higher on greens. (That increase could be related to shortages stemming from damage from Hurricane Matthew and an unusually warm winter in much of the country. Read SAF’s coverage of that issue and how it could affect Mother’s Day.)

About 41 percent of respondents said customers “sometimes” ask about flower origin. Thirty-two percent said the question is posed “rarely” and 21 percent said it happens “frequently.” Five percent said they never get the question and less than 1 percent said they “always” get it. (These percentages are consistent with last year’s findings.)

Respondents on average hired eight additional workers for Valentine’s Day, compared to the six workers shops brought in on average last year.

National Marketers Weigh In

In addition to reaching out to SAF members through its post-holiday survey, SAF also queried national companies, including start-ups featured recently in Floral Management magazine. Highlights from their responses are below.

1-800-Flowers.com/BloomNet. As a public company, sales results were not available at press time. “What I can tell you is this Valentine’s, as always, we are laser-focused and committed to our customer experience,” said Yanique Woodall, a vice president. “We were delighted to see some of our tech innovations such as GWYN, online gift concierge powered by IBM Watson, be a part of the customer experience.”

FTD. As a public company, sales results were not available at press time. “We have received a lot of positive feedback from florists about a strong holiday overall,” said Emily Bucholz, FTD’s marketing and events director, who said average order values across the network appeared to be “in line” with company expectations. For the first time this year, FTD offered a limited selection to consumers (with the exception of sympathy orders) in the days leading up to the holiday. “An early read shows positive consumer satisfaction, which is the ultimate goal to improve fulfillment by having a smaller selection of arrangements, cultivate a positive consumer experience and increase repeat flower purchases to positively impact the industry,” Bucholz said.

Teleflora. David Dancer, executive vice president and head of marketing for Teleflora, “A Tuesday holiday, coupled with strong consumer demand for hand-arranged bouquets, drove order volume success for our florists businesses and Teleflora.com,” he said, adding that company experienced “over 20 percent order volume increases for eFlorist) sites andTeleflora.com as well as dramatic increases in florist-to-florist orders, showing that our florists were having a great holiday locally as well.” The mid-week holiday meant that “orders surged on Monday and continued through and past the holiday. This year in particular, we saw strong orders through Friday, 2/17,” he said. “From a logistics and fulfillment perspective, our florist partners were very well prepared to handle the last-minute surge in orders, so much so, that for many zip codes, Teleflora was accepting orders through noon on Valentine’s Day for same-day delivery.”

BloomNation. Co-founder and CEO Farbod Shoraka reported a “huge jump up from last year, roughly 50 percent on average for a BloomNation florist.” Like florists in SAF’s survey, Shoraka pointed to the day of the week: “We’ve noticed that consumers tend to begin purchasing the week of Valentine’s Day and there is always a spike the day before the 14th,” he said. “Given that customized gifts, and are helping orchestrate visits for long-distance couples and a few military families.”

At press time, E-Brief editors had reached out to but not heard back from representatives of Farmgirl Flowers.