Look out, 2018: Many floral industry members are heading into the new year with high expectations.

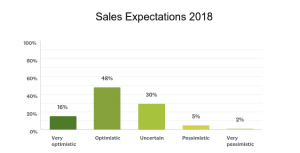

Forty-eight percent of respondents to the Society of American Florists’ recent Economic Outlook Survey said they are “optimistic” about sales expectations in 2018 — another 16 percent said they are “very optimistic.” About 30 percent classified their feelings as “neutral/uncertain.” Five percent said they are “pessimistic”; almost 2 percent said they are “very pessimistic.”

Among respondents, industry members in the South, growers, and those respondents with businesses in suburban locations appear to be most optimistic about sales expectations. Survey respondents included all segments of the industry — retailers, wholesalers/suppliers/importers and growers. (The vast majority of respondents were retailers.)

Overall, 49 percent of respondents said business right now is “good,” and nine percent said it’s “excellent.” Thirty-eight percent said it’s “okay.” Meanwhile, 3 percent called business “poor” and, for 1 percent, it’s “ terrible.”

Even among those who expressed optimism for 2018, discipline and vigilance became constant themes — few industry members appear to be taking any sales or profit margins for granted.

“We are focusing on better measurements of margins and productivity, as we can no longer expect sustainability unless major changes are made,” explained one retailer in Illinois.

“I have tried to control cost of goods and really trim the number of items on my web site, yet still offering a nice variety,” said another retailer, in Kansas. “ also controlling payroll.”

Source: SAF Economic Outlook. Emailed January 21, 2018, to SAF members. 11% response rate.

Reaching out to new customers, and staying abreast of digital marketing trends, was another theme in write-in responses.

“We are investing heavily in SEO and other marketing and advertising,” said one florist in Oklahoma.

Looking at responses by geographic region:

- 58 percent of respondents from New England said they are “optimistic” about sales in 2018. Eight percent said they are “very optimistic.” Twenty-nine percent said they are “neutral/uncertain.” Five percent are “pessimistic.”

- Forty percent of respondents in the Midwest are “optimistic”— another 15 percent said they are “very optimistic.” Thirty-seven percent are “neutral/uncertain.” Remaining respondents are either “pessimistic” or “very pessimistic.”

- Forty-five percent of Southerners are “optimistic” and 26 percent are “very optimistic.” Twenty-one percent are “neutral/uncertain.” The rest were “pessimistic” or “very pessimistic.”

- Fifty-four percent of respondents from the West said they are “optimistic”; 13 percent are “very optimistic.” About 27 percent are “neutral/uncertain.” Remaining respondents were “pessimistic” or “very pessimistic.”

- Respondents from Canada were split 50/50 between “optimistic” and “very optimistic.”

Among industry segments:

- Seventy-five percent of growers said they are “optimistic.” The remaining 25 percent said “very optimistic.”

- Seventy-one percent of respondents in the wholesaler/supplier/importer segment said they are “optimistic”; 14 percent said “very optimistic.”

- Forty-six percent of retailers said they are “optimistic”; 15 percent said “very optimistic.” About 31 percent said “neutral/uncertain.” The remaining respondents were “pessimistic” or “very pessimistic.”

Meanwhile, 39 percent of respondents who self-identified as urban locations said they are “optimistic”; 19 percent are very optimistic. In addition:

- Fifty-one percent of suburban respondents ae “optimistic”; 20 percent are “very optimistic.”

- Forty-nine percent of small town respondents are “optimistic”; 10 percent are “very optimistic.”

- Sixty-two percent of rural respondents are “optimistic”; 5 percent are “very optimistic.”

Sales Trends: Up for Many

Fifty-one percent of all respondents said gross sales for 2017 increased over 2016. About 24 percent said those sales were the same and another 24 percent said they dropped.

Among those who saw gross sales drop, around 72 percent said the decrease was fairly small, between 1 and 10 percent. About 23 percent charted a steeper drop-off (11 to 20 percent). The remaining respondents said sales dropped by 21 percent or more.

Among those who saw gross sales increase, about three-quarters said the uptick was between 1 and 10 percent. About 19 percent experienced an increase of 11 to 20 percent, 5 percent saw an increase of 21 to 30 percent, 2 percent saw gains of 31 to 50 percent and almost 1 percent saw increases of 51 percent or more.

Retailers said their average transaction is slightly more than $66.

About two-thirds of respondents who said net profits were down said the decline was between 1 and 10 percent. Twenty-four percent said the dip was between 11 and 20 percent. The remaining respondents said decreases were of 21 percent or more.

Among those who said net profits were up, most (80 percent) said the increase was between 1 and 10 percent. About 17 percent said net profits increased between 11 and 20 percent. The remaining respondents saw an increase of 21 percent or more.

Look for more coverage of survey results, including spending plans for 2018 and insight into the issues respondents are most concerned about and trends in buying and consumer demand of sustainably produced products and materials.