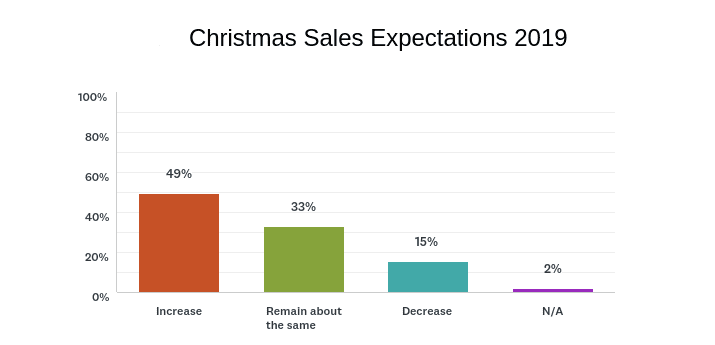

With one week to go until Christmas, most retail florists feel optimistic about the 2019 holiday season, according to a Society of American Florists’ holiday “gut check” survey. Around 49 percent of respondents to that survey said they are planning for a sales increase, compared to 2018 returns. Another 33 percent said they expect 2019 sales to look pretty similar to results from the strong 2018 season, when 60 percent of florists reported an uptick in sales.

Smaller florists, those with annual sales between $150,000 and $299,999 a year, and large operations, those with $1 million or more in annual sales, are among the most bullish on the holiday season, with 58 percent and 60 percent of those groups respectively predicting a sales increase this year.

The survey was sent via email on Dec. 3 and had a response rate of 10.5 percent.

SAF gut check surveys have proven in recent years to be a good predictor of holiday results: Last year, 58 percent of respondents to the 2018 pre-holiday survey said they were planning for a sales increase. While the economy remains relatively stable compared to last year, other factors, including a late Thanksgiving (on Nov. 28), could be contributing to slightly tempered expectations.

Looking at results by region, respondents from the Northeast (Maine, Connecticut, Vermont, New Hampshire, Massachusetts and Rhode Island) were the most optimistic, with 63 percent of respondents expecting a sales increase. More retailers in the Pacific region (Alaska, Washington, Oregon, California and Hawaii), south central states (Kentucky, Tennessee, Mississippi, Alabama, Texas, Oklahoma, Arkansas and Louisiana) and the mid-Atlantic area (New York, Pennsylvania, New Jersey) also expressed optimism about the holiday, compared to other parts of the country.

Despite the tighter holiday timeline, most retailers stuck to a pattern of putting up Christmas displays in November, with 46 percent doing so before Thanksgiving and 20 percent waiting until after Nov. 28. (About 22 percent of respondents decked their halls in October; another 8 percent strung jingle bells all the way back in September.) The results track closely with responses from previous years.

In write-in responses, retailers shared stories of successful promotions — many of them experience-based.

“We are changing our early marketing to let people know about wreaths, poinsettias and grave blankets,” explained one Ohio florist. “This has been great for helping us sell those items. We differentiate ourselves by highlighting the fact that we carry premium versions of these products.”

“We do a ‘Girls’ Night Out’ sale and another evening with Santa and Mrs. Claus,” wrote a florist in New Jersey. “Both are a great success. Girls’ night definitely brings in more money, but Santa night gets the young families in so they can continue to come back as the kids get older.”

“We host our holiday open house each year at the end of October,” shared a retailer in Texas. “Our team works hard to gain new business each year by calling businesses we have relationships with to try to get their decorating business.”

“We host our holiday open house each year at the end of October,” shared a retailer in Texas. “Our team works hard to gain new business each year by calling businesses we have relationships with to try to get their decorating business.”

Write-in responses also touched on holiday trends.

“Prices are higher across the board, so service, service, service, to create a pleasant alternative to malls and other competition,” wrote a florist in Massachusetts.

A California retailer seemed to agree, writing that “we have to be ever changing and always fresh with displays, designs and positive vibe. We are a small business so people will seek us out as long as we are relevant and interesting.”

The omnipresent Amazon effect — tighter delivery timetables, heightened customer expectations, delayed ordering — is very real at the holidays, added a florist in Ohio. “We have noticed over the past five years that people wait to order closer and closer to the delivery day. This makes having the right flowers in stock a little trickier.

In addition to asking florists about December holiday sales expectations, the survey also queried them on fall holiday results. Some highlights include:

Halloween: Flat Sales, Little Promotion Effort

Halloween sales were flat for about 68 percent of respondents — but most florists (about two-thirds of respondents) said they did not promote the holiday to their customers. (Those numbers align with last year’s answers.)

Roughly 68 percent of respondents said that Halloween-themed or -colored fresh flowers were the best seller for the holiday. Only 10 percent of respondents hosted a Halloween event in their store. Meanwhile, about 18 percent said they offered Halloween specials.

“We do not promote Halloween as it is a single, nonprofitable day,” explained a California retailer. “We choose to offer a harvest time tied into Thanksgiving Day, which seems to be a longer celebrated holiday.”

But not everyone has given up on the day. “We painted on the shop windows, danced around outside to music and gave out loads of candy,” wrote a florist in Tennessee. “It was mentioned in the paper and on Facebook.”

Thanksgiving: More Confident Consumers

Forty percent of respondents said their 2019 Thanksgiving sales were about on par with 2018 returns; 32 percent saw an increase, 26 percent experienced a decrease and the remaining respondents weren’t quite sure how they fared, or the question was not applicable to them.

Those responses are about on par with 2018 results; however, in write-in responses, a number of florists noted a bit more energy (and spending) for the November holiday this year.

“ new style of designs, drawing from boho weddings,” wrote a Massachusetts florist. “It created a nice stir and upped spending on arrangements.”

“Sales have been better overall,” agreed an Ohio florist. “I don’t think any one thing we did contributed to that. I just think people feel more like spending money.”

“Having lower priced centerpieces on our website, which is not our usual tactic, seemed to generate more orders,” wrote a florist in Texas.

But it wasn’t all gravy. Several respondents noted that Thanksgiving spending has dwindled in the last decade as consumers forgo formal, traditional celebrations in favor of more casual get-togethers.

“It’s turned mostly into a non-event,” wrote a florist in New Mexico. “Everyone mostly buys at the grocery or big box stores or don’t bother with flowers on this holiday anymore.”

Black Friday, Small Business Saturday and Cyber Monday: Whole Lotta Nothing?

The shopping days of the busy post-Thanksgiving weekend continue to be rather slow days for many in the industry, with some florists saying they prefer to dedicate the time to prepping for Christmas rather than competing head-to-head for customers’ attention with bigger national companies.

Nearly half of respondents said Black Friday sales this year lined up with results for the day in 2018. About 73 percent of respondents said they did not promote Black Friday deals at all.

“We don’t generate business on Black Friday,” a florist in Delaware wrote. “It’s actually one of the slowest days of the year.”

“We were busy, but not with any Black Friday business — just everyday orders, funerals, and event stuff,” another florist in Ohio explained.

About 41 percent of respondents said sales were about the same as 2018 levels for Small Business Saturday. Roughly 21 percent saw an increase; 17 percent noted a decrease. (The rest said they didn’t know results for the day or that Small Business Saturday is not applicable to them.) Forty-two percent of respondents said they had special deals they promoted for the day.

The success of the event seems to depend heavily on a shop’s location and local community.

“Clients were aware of the day and wanted to help promote local businesses,” wrote a florist in New York.

“It was the same as Friday,” shared an Alabama florist. “This is typically one of our slowest days of the entire year. We do about 25 to 30 deliveries, and we typically do 60 to 80 on a Saturday.”

About 41 percent of respondents said they don’t track Cyber Monday sales — or the day doesn’t apply to them. About 38 percent said the day’s sales were on par with Cyber Monday 2018. Twelve percent charted an increase, and 8 percent saw a decline. About 81 percent of respondents did not advertise Cyber Monday specials.

“Cyber Monday is not a florist holiday, so I don’t think anything would help,” wrote a florist in Ohio.

“We’ve never had much success with this and so didn’t expend the effort on it this year,” agreed a florist in Washington.

Look for post-holiday coverage in future SAF publications.

Have a holiday promotion that worked like a charm? Share your story. Email mwestbrook@safnow.org.

Mary Westbrook is the editor in chief of Floral Management magazine.