SAF members soaked in some free guidance on how to determine a business is worth during a recent SAF Web Blast, led by financial consultant Derrick Myers, CPA, CFP, PFCI.

Considering selling your business in the next few years — or even few decades? The time to prepare is now.

That was one of many takeaway lessons from a recent SAF WebBlast with Derrick Myers, CPA, CFP, PFCI of Crockett Myers.

During the 20-minute session, Myers, a contributing writer for SAF’s Floral Management magazine, presented insight on common ways to establish a retail value for a floral business, and he talked about how owners can best position themselves today, to secure the highest offer.

Selling a business can be an intimidating process. As Myers noted, “I always talk about fair, but what the buyer and seller thinks are fair are often different things.”

That’s why it’s helpful for buyers and sellers to understand key terms, including the difference between tangible assets (inventory, vehicles, coolers, etc.) and intangible assets (customer base, brand loyalty, etc.), along with common approaches to valuation. Those include:

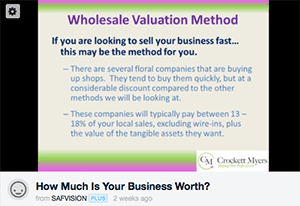

Wholesale. Larger shops acquire smaller businesses and run them as satellite locations. Pros: “These guys move quick,” Myers said. “If they decide they’ll buy your shop, it happens in 30 to 60 days.” Cons: The fast turnaround usually means a lower price, compared to other approaches; usually 13 to 18 percent of local sales.

Absorption. A shop buys another business, generally in the same delivery area, and absorbs it. This is a way for a business to essentially buy another company’s customer list. The buyer generally closes the location after buying it; tangibles are often sold separately. “This is the most popular method right now,” Myers said. “I probably have eight clients who have done this in the last year. Pros: More money for the seller (about 20 percent of local sales). Cons: Sellers don’t get cash up front — buyers will pay an agreed upon percentage of sales generated from the seller’s business for a set period of one to two years — so there’s some risk; the sellers needs to be sure the buyer is able to keep those sales strong.

Broker. Brokers negotiate the sale between buyer and seller. Pros: Brokers tend to overvalue floral industry businesses, Myers said, because they work outside of the industry and frequently sell to people outside of it. This can mean more cash for the seller. Cons: These deals tend to take much longer than other approaches.

Professional. This is done, at a cost of $3,000 to $5,000, by a CPA or certified valuation analyst. Pros: “It’s the only valuation that will stand up in a courtroom defense,” Myers pointed out. Plus, it can usually lead to a good price for buyer and seller, usually three to five times the excess cash flow number. Cons: To come up with that price, the professional needs to review five years of financials and make adjustments to account for owner compensation, rents and perks (such as vehicles and health insurance.) Those calculations take time.

In the end, of course, Myers reminded participants, “your business is worth what a seller is willing to pay for it.”

SAF members can access the recorded version of the webinar for free here.